KUALA LUMPUR, Sept 24 — CGS-CIMB Research estimates the RM10 billion PRIHATIN Supplementary Initiative Package (KITA PRIHATIN) will increase the Ministry of Finance’s last projected budget deficit by 0.7 per cent of gross domestic product (GDP).

The estimated budget deficit may be less if part of the expenditure falls under Budget 2021 or if the funds are reallocated from other budgeted expenses, it said in a research note today.

“While KITA PRIHATIN will stretch fiscal metrics further, headroom was created after the Parliament approved the raising of the government debt ceiling to 60 per cent of GDP in August this year,” the research house said.

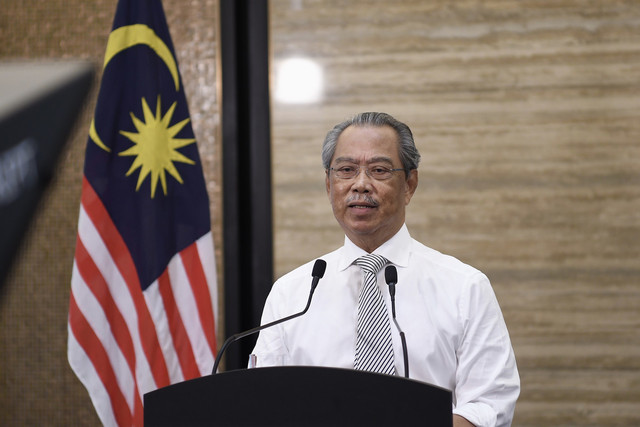

Yesterday, Prime Minister Tan Sri Muhyiddin Yassin unveiled KITA PRIHATIN, comprising the RM7 billion Bantuan Prihatin Nasional 2.0 (BPN 2.0), RM2.4 billion Targeted Wage Subsidy Programme and RM600 million Prihatin Special Grant (GKP).

The KITA PRIHATIN package is the extension of the previous economic stimulus packages, namely the Prihatin Rakyat Economic Stimulus Package (PRIHATIN), Prihatin SME Plus and National Economic Recovery Plan (PENJANA) worth a total of RM295 billion, or about 20 per cent of the nation’s gross domestic product, with an additional fiscal injection by the government totalling RM45 billion.

CGS-CIMB Research said it is maintaining its GDP forecast of -4.0 per cent in 2020 and its budget deficit forecast at 6.5 per cent of GDP.

“While we believe Bank Negara Malaysia (BNM) has signalled an end to its monetary easing cycle after the 125 basis points Overnight Policy Rate (OPR) cuts to 1.75 per cent, should political uncertainty result in delayed fiscal and non-fiscal spending, BNM may revisit its macroeconomic projections and monetary policy stance in a more dovish direction,” it said.

Meanwhile, Kenanga Investment Bank Bhd has revised its fiscal deficit forecast to 7.5 per cent of the GDP from 6.8 per cent previously following the additional stimulus, which is expected to be financed via domestic borrowing, predominantly through the issuance of Malaysian Government Securities, Government Investment Issues and Malaysian Islamic Treasury Bills.

Given the higher fiscal deficit, it said, the government debt is estimated to increase to 62.6 per cent of GDP by end-2020, exceeding the statutory limit of 60.0 per cent.

“The spike in debt ratio is justifiable in an environment of economic turbulence, so long as the government commits to taper it down once the economy stabilises,” it said.

Kenanga said the additional stimulus is timely as it would partly cushion the impact from the anticipated slower consumer spending following the end of the loan repayment moratorium on Sept 30.

“Given the rather elevated level of uncertainty in the global economy and the risk of further rise in COVID-19 infections globally, we maintain our GDP forecast for 2020 at -5.9 per cent (2019: 4.3 per cent).

“Nevertheless, we still expect a gradual recovery in the second half of 2020 supported by the accommodative monetary policy and expansionary fiscal measures. However, risks arising from elevated geopolitical tension and concerns over rising risk premium on the domestic political front remain,” it said.

Kenanga also revised its GDP growth projection for 2021 to 5.3 per cent from 5.1 per cent earlier.

Meanwhile, AmBank Research said the local economic conditions are improving, noting that the Leading Index (LI) had increased for the third consecutive month, with July reading showing an acceleration of 7.7 per cent year-on-year (y-o-y) from 4.6 per cent y-o-y in June — marking the fastest expansion since March 2010.

On a monthly basis, the LI grew by 4.4 per cent month-on-month (m-o-m) in July from 3.8 per cent m-o-m in June.

This suggests that the economic recovery is gaining some momentum following the relaxation of the Movement Control Order, it said.

“This could mean that BNM is done with its rate cutting. The OPR is expected to stay unchanged at 1.75 per cent.

“The cumulative 125 basis points’ cut in OPR this year, coupled with fiscal stimulus measures amounting to RM305 billion would continue to provide support to the economy,” added AmBank. -BERNAMA